From 1st March 2019 SDLT must be submitted and paid within 14 days of completion

Are you ready for this change?

As of 1st March 2019 the timeframe to submit a Stamp Duty Land Tax (SDLT) return, and pay any SDLT due, will reduce from 30 days to 14 days from the effective date of the transaction. Pali’s recently launched Post Completion System enables solicitors, conveyancers and support staff across England and Wales to submit their SDLT or LTT and AP1 forms via the Pali Platform in a quick and easy way using advanced time-saving tools. The soon to be reduced timeframe of 14 days does not apply to Wales however, and by utilising the Pali system this will help keep timelines in order as the system will detect whether the property in question is English or Welsh, making it one less thing for you to worry about.

Pali made the decision to expand the functionality of their online system to allow their clients to complete all their tasks under one roof. Streamlining the post-completion process for users not only improves efficiency but Pali’s SDLT or LTT and AP1 application drastically reduces the risk of human error due to the high level of technology applied. Information is automatically passed across from the SDLT/LTT to the AP1 submission forms removing the need to re-key duplicate data thus saving valuable time. Furthermore, for Commercial conveyancers you can submit your MR01 and MR04 forms online and the system even incorporates the eSubmitting of Welsh Land Transaction Tax by enabling users to manage LTT Submissions along side the English SDLT equivalents.

There are many other benefits in using Pali’s SDLT and AP1 system including a full permanent audit trail, the facility to draft forms in advance and flexibility to skip between sections in no particular order.

- Seamless integration with HMRC SDLT return or WRA LTT and Land Registry’s AP1 application process

- Helps you comply with the Law Society rules

- Easy to use as Same layout as paper version

- Errors reported before submission attempt

- HMRC online access not necessary to draft and process forms

- Forms are never deleted unlike with HMRC, making your GDPR requirements easier to manage and administer

- Can create multiple time-saving templates and stores details for re-use

By utilising Pali’s Post Completion System you can rest assured your SDLT/LTT and AP1 lodgements will be completed in the fastest, simplest way.

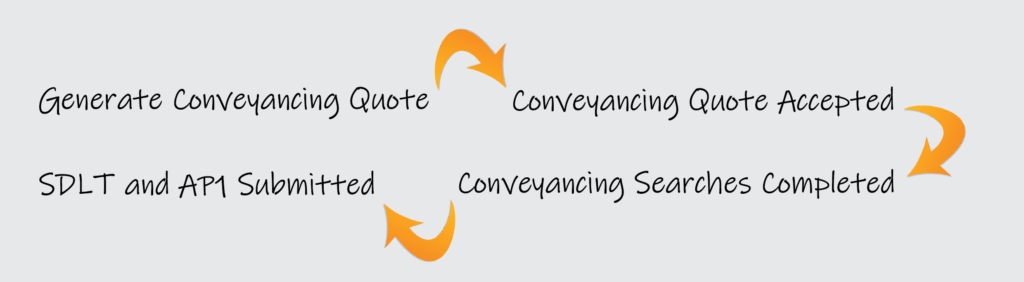

Pali’s latest development means clients can now manage the whole process from start to finish:

Once you have entered the initial information there is no need to enter it again. The data is automatically passed across every stage removing the need to continuously type the same details over and over again therefore speeding up the process and freeing up time for you to spend on more pressing matters. Everything is carried out from the same platform which acts as a ‘one stop shop’ and as we have integrated with Case Management Systems you only need to log in to one system, to access everything you need. If you use a Case Management System we haven’t integrated with we are more than happy to integrate with them.

For more information or to arrange a demonstration please contact a friendly member of the Pali team on 0800 023 5030 / search@paliltd.com